Estimating tax payable#

In this example we are given the following scenario:

Personal tax (before deductions) in Australia is based on the table below. The tax payable at the end of the financial year depends on the individual’s income. The higher the income, the higher the tax rate, as defined by tax brackets (or tiers). Given a list of incomes, calculate the corresponding tax payable for each income.

Income Thresholds |

Rate |

Tax payable |

|---|---|---|

$0 - $18,200 |

0% |

Nil |

$18,200 - $45,000 |

19% |

19c for each $1 over $18,200 |

$45,000 - $120,000 |

32.5% |

$5,092 plus 32.5c for each $1 over $45,000 |

$120,000 - $180,000 |

37% |

$29,467 plus 37c for each $1 over $120,000 |

$180,000 and over |

45% |

$51,667 plus 45c for each $1 over $180,000 |

We start by importing pandas, numpy and piso, and creating an interval index for the tax brackets.

In [1]: import pandas as pd

In [2]: import numpy as np

In [3]: import piso

In [4]: tax_brackets = pd.IntervalIndex.from_breaks(

...: [0,18200,45000,120000,180000,np.inf],

...: closed="left",

...: )

...:

In [5]: tax_brackets

Out[5]: IntervalIndex([[0.0, 18200.0), [18200.0, 45000.0), [45000.0, 120000.0), [120000.0, 180000.0), [180000.0, inf)], dtype='interval[float64, left]')

With each interval in the tax bracket, we’ll associate three values:

the lower threshold for the tax bracket

the fixed amount payable

the tax rate for each dollar above the threshold (as a fraction)

We describe this data as a pandas.DataFrame indexed by tax_brackets.

In [6]: tax_rates = pd.DataFrame(

...: {

...: "threshold":tax_brackets.left,

...: "fixed":[0, 0, 5092, 29467, 51667],

...: "rate":[0, 0.19, 0.325, 0.37, 0.45],

...: },

...: index = tax_brackets,

...: )

...:

In [7]: tax_rates

Out[7]:

threshold fixed rate

[0.0, 18200.0) 0.0 0 0.000

[18200.0, 45000.0) 18200.0 0 0.190

[45000.0, 120000.0) 45000.0 5092 0.325

[120000.0, 180000.0) 120000.0 29467 0.370

[180000.0, inf) 180000.0 51667 0.450

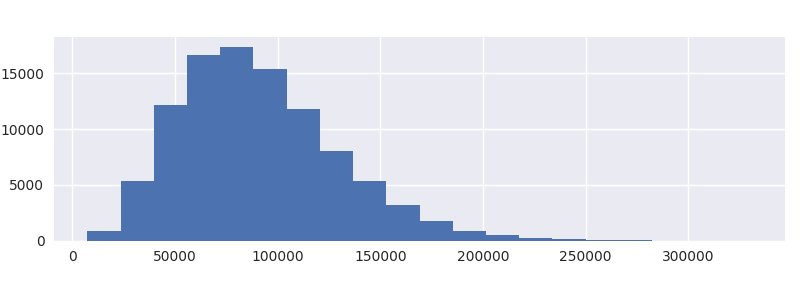

For the income, we’ll generate some random integers (and plot the distribution) corresponding to 100,000 individuals.

In [8]: income = pd.Series(np.random.beta(5,50, size=100000)*1e6).astype(int)

In [9]: income.plot.hist(bins=20);

We are now in a position to use piso.lookup(), which take two parameters:

a

pandas.DataFrameorpandas.Serieswhich is indexed by apandas.IntervalIndexthe values which are will be compared to the interval index

In [10]: tax_params = piso.lookup(tax_rates, income)

In [11]: tax_params

Out[11]:

threshold fixed rate

61371 45000.0 5092 0.325

56606 45000.0 5092 0.325

115348 45000.0 5092 0.325

39578 18200.0 0 0.190

48203 45000.0 5092 0.325

... ... ... ...

38366 18200.0 0 0.190

146076 120000.0 29467 0.370

67726 45000.0 5092 0.325

20210 18200.0 0 0.190

60895 45000.0 5092 0.325

[100000 rows x 3 columns]

The result is a dataframe, indexed by the values of income, sharing the same columns as tax_rates.

We can then use a vectorised calculation for the tax payable:

In [12]: tax_params["fixed"] + (tax_params.index-tax_params["threshold"])*tax_params["rate"]

Out[12]:

61371 10412.575

56606 8863.950

115348 27955.100

39578 4061.820

48203 6132.975

...

38366 3831.540

146076 39115.120

67726 12477.950

20210 381.900

60895 10257.875

Length: 100000, dtype: float64

Alternative approaches#

There are a couple of alternative, straightforward solutions which do not require piso which we detail below.

Alternative 1: pandas.cut

The tax_params dataframe that was produced above by piso.lookup() can be reproduced using pandas.cut() which can be used to assign bins to data with an interval index.

In [13]: tax_params = tax_rates.loc[pd.cut(income, tax_brackets)].set_index(income)

In [14]: tax_params

Out[14]:

threshold fixed rate

61371 45000.0 5092 0.325

56606 45000.0 5092 0.325

115348 45000.0 5092 0.325

39578 18200.0 0 0.190

48203 45000.0 5092 0.325

... ... ... ...

38366 18200.0 0 0.190

146076 120000.0 29467 0.370

67726 45000.0 5092 0.325

20210 18200.0 0 0.190

60895 45000.0 5092 0.325

[100000 rows x 3 columns]

This approach however runs approximately 20 times slower than piso.lookup().

Alternative 2: applying function

The second approach involves writing a function which takes a single value (an income for an individual) and returns the tax payable. The function can then used with pandas.Series.apply

In [15]: def calc_tax(value):

....: if value <= 18200:

....: tax = 0

....: elif value <= 45000:

....: tax = (value-18200)*0.19

....: elif value <= 120000:

....: tax = 5092 + (value-45000)*0.325

....: elif value <= 180000:

....: tax = 29467 + (value-120000)*0.37

....: else:

....: tax = 51667 + (value-180000)*0.45

....: return tax

....:

In [16]: income.apply(calc_tax)

Out[16]:

0 10412.575

1 8863.950

2 27955.100

3 4061.820

4 6132.975

...

99995 3831.540

99996 39115.120

99997 12477.950

99998 381.900

99999 10257.875

Length: 100000, dtype: float64

This approach runs approximately 3 times slower than piso.lookup(). It also requires a function to be defined which is relatively cumbersome to implement. This approach becomes increasingly unattractive, and error prone, as the number of tax brackets increases.